california mileage tax bill

But opponents are concerned the legislation is laying the groundwork for a permanent mileage tax. Those paying mileage tax receive credit on their bills for fuel taxes they pay at gas stations.

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune

As of September 30 2021 the vote on the Infrastructure Bill was delayed.

. Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 1515 per statute mile. California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. However if an employers policy sets a higher per-mile reimbursement rate they may pay the higher amount.

I have been resisting against all common sense leaving California completely. Heres a breakdown of the current IRS mileage reimbursement rates for California as of January 2020. As of January 2021 the Internal Revenue Service slightly decreased the required reimbursement rate per mile from 0575 cents per mile to 056 cents per mile.

On June 24 2021 President Biden announced a 12 trillion dollar Bipartisan Infrastructure Framework as part of his Build Back Better vision notes a White House press release on the matter. Ive got a 55 Buick that fits the bill. Private Aircraft per statute mile.

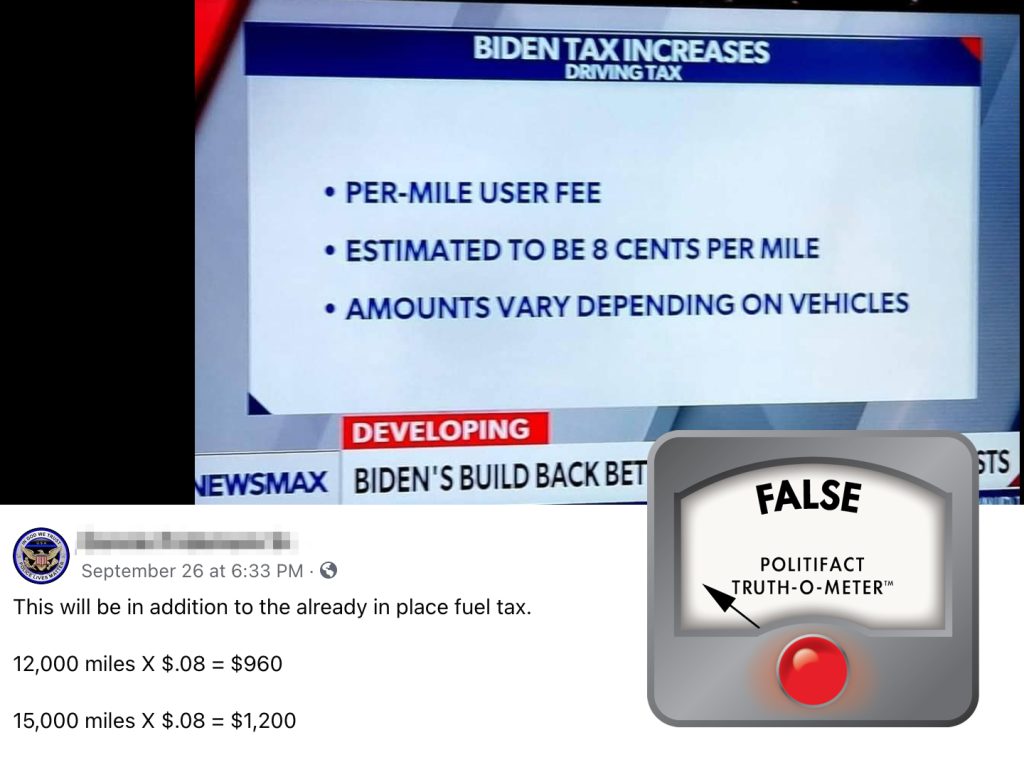

Jerry Brown has received legislation that would make California the third West Coast state to test replacing state fuel tax with a vehicle-miles-traveled fee. The proposal is in the 12 trillion 2700-page Infrastructure Bill that passed in the US. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

CORONADO KUSI If youre one of the 97 who drives a car here in San Diego then get ready to fight or pay a lot more money for that same car. California is the second state to test mileage fees in recent years joining Oregon which launched a pilot program of its own in 2014. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg.

California is looking at a possible mileage tax to replace the lost taxes when the state converts to zero emission new cars in 2035. Part of the package includes proposing a vehicle mileage tax pilot program. For instance a sedan may have to pay less mileage.

The San Diego Association of Governments board of directors passed the 2021 Regional Transportation Plan without the controversial road mileage tax Friday but questions remain as to how the. A mileage tax would not be calculated on a per gallon basis. Reimbursement Rate per Mile.

This includes 10 million each year from 2022 to 2026. The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code. If you follow the stock market you know that markets have been highly volatile in 2022.

California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. Hence all vehicles will have to pay the same amount as mileage tax regardless of their fuel type or fuel efficiency. Road Charge is an alternative funding mechanism that allows drivers to support road and highway maintenance based on how many miles they drive instead of how many gallons of gas they use.

Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile Employees will receive 17 cents per mile driven for moving or medical purposes this is a substantial increase from just 2. A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting on Friday. It calls for a pilot program tracking participants driving distances through GPS.

California mileage tax bill. I dont want to sell my home but it is time. Keep in mind Californians pay the highest.

Instead of paying at the pump when purchasing fuel a mileage tax system determines a drivers vehicle. You can catch the recent wave of stock market volatility to lower your 2022 taxes on capital gains. Replacing Californias gas tax.

Personal Vehicle approved businesstravel expense 0585. The California legislature passed a bill extending a road usage charge pilot program. Online videos and Live Webinars are available in lieu of in-person classes.

Just like you pay your gas and electric bills based on how much of these utilities you use a road charge - also called a. Today this mileage tax. Tags Fuel tax Gas Tax Highway bill Vehicle miles traveled tax.

Since 2015 the program allows the state to study a road user charge based on vehicle miles traveled as an alternative to fuel taxes. Instead it would be calculated on a per mile basis. Governmental leaders across California as well as in other states such as Utah and Oregon have been looking at how to replace the gas tax in the coming decades due to gas.

The infrastructure bill includes 125 million to fund pilot programs to test a national vehicle miles traveled fee. Please contact the local office nearest you. Personal Vehicle state-approved relocation 018.

Businesses impacted by the pandemic please visit our COVID-19 page. The mileage may vary depending upon the weight of the vehicle. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

Have found Florida to be much. 1077 to establish an advisory committee to study a road usage fee was signed into law by California Governor Jerry Brown. For questions about filing extensions tax relief and more call.

The bill which passed the state legislature with the backing of transit agencies environmental groups and most major automakers.

Mileage Tax Study Not Actual Mileage Tax Proposed In Infrastructure Bill Ap Berkshireeagle Com

San Diego Driving Tax Locals Torn Over Per Mile Road Usage Tax Discussed By Sandag

What San Diegans Should Know About The 160b Plan For Transit And Road Charges Approved On Friday The San Diego Union Tribune

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

Sandag Plan Board Of Directors Approves 160 Billion Transportation Plan Cuts Out Mileage Tax

Mile Marker A Caltrans Performance Report Spring 2020 Caltrans

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

We Ll Need To Replace The Gas Tax In Transition To Zevs Calmatters

Irs Raises Standard Mileage Rate For 2022

Secured Property Taxes Treasurer Tax Collector

County City Leaders Push Back Against Proposed Mileage Tax

Mileage Tax Is Coming Pay Per Mile And Gas Taxes Explained Youtube

Pros And Cons Of A Vehicle Mileage Tax Glostone Trucking Solutions

Vehicle Miles Traveled Tax Proposed

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Paying By The Mile For California Roads Infrastructure Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

What Are The Mileage Deduction Rules H R Block

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Politifact Biden Infrastructure Plan Wouldn T Establish A Per Mile Driving Tax Nbc 6 South Florida